When you use credit cards today, it's like playing a fun game. You get points and badges that make you feel good, just like winning at your favorite game. You can even play with friends to see who gets the most rewards!

Think about it – every time you buy something, you get special treats back. It feels better than paying with cash because you get rewards. Your phone shows you how many points you have and gives you fun challenges.

But be careful! These games can make you spend more money than you planned. It's smart to know how these tricks work so you can make better choices with your money.

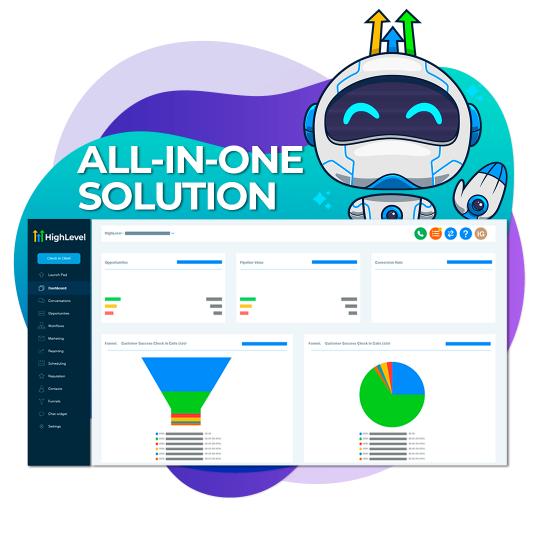

Tired of Losing Track of Your Customer Sales?

A good CRM helps you stay on top of every sale. It keeps all your customer info in one place, sends follow-up emails for you, and shows you who's ready to buy. You'll save hours each day and never miss a sale again.

Key Takeaways

Your cards play tricks with your mind. They make spending feel fun, like a video game.

When you spend money, your brain feels good. It's like getting points in a game. You want to keep going.

Many people share what they buy with friends. They try to win small contests. This makes them use their cards more.

Cards have special levels you can reach. The more you spend, the better rewards you get. It's like moving up in a game.

Phone apps make using cards feel like a fun game. You get quick treats and prizes when you buy things.

The Psychology Behind Credit Rewards

Credit card rewards make our brains happy. When we use a credit card to buy things, our brain gives us good feelings. It feels nice, like getting a treat. This makes us want to use our cards more.

Using a credit card feels better than paying with cash. We feel less sad about spending money. When we get points or money back, it makes us smile. It's like getting a small gift each time we shop.

Many people feel the same way about credit rewards. Our brains love getting these little rewards. We start to think more about the fun rewards than the money we spend. This makes us reach for our credit cards instead of cash.

Gaming Elements That Hook Users

When you use gamified credit cards, you can earn rewards in two fun ways.

First, you get points when you buy things. Think of these points like tickets at an arcade. The more you spend, the more points you collect.

Second, you can win badges. These are like gold stars that show how well you're doing. As you earn more badges, you unlock better perks.

It's like moving up levels in a video game – the more you play, the more cool stuff you get.

Points Drive Daily Spending

When you use your credit card, you can earn points like a fun game. You get points when you buy things at stores, finish special tasks, or shop at certain places.

The credit card company makes it feel like a game. You can reach new levels and win cool prizes. Each level gives you better rewards than the last one. You can also share your wins with friends who play the same game.

The game makes buying things more fun. Every time you use your card, you move up in the game and get closer to prizes.

Sick of wasting hours on marketing that doesn’t pay off?

What if you could skip the hard work and still grow your business?

Automate your marketing and see how easy it can be to save time and close more deals.

Discover the simplest way to take charge of your business!

Badges Unlock Premium Perks

Badges make credit cards more fun to use. Just like in video games, you can earn special badges when you use your card. These badges help you get cool rewards and make you feel good about using your card.

When you use your card, you can:

- Win badges to get better card perks

- Get special badges during sales

- Show your badges to other card users

- Play fun money games with your card

Banks use badges to make you want to use their card more. The more you use it, the more badges and rewards you get. This makes people happy to pick the same card over and over when they buy things.

The badges work because they give you nice things right away, but also make you want to keep using the card for a long time. It's like playing a game where you keep getting better prizes the more you play.

Points, Badges, and Digital Trophies

Every time you buy something with your credit card, you can earn fun rewards like points and special badges.

It's like playing a game where each purchase helps you win prizes. When you collect enough points, you can move up to new levels.

At higher levels, you get better rewards that other people can't get. Many people enjoy watching their points grow with each purchase, just like scoring points in their favorite games.

Achievement Unlocks Shopping Habits

Credit cards can be like video games. They give you fun rewards when you spend money. You get points and special badges that make you feel good.

Your card gives you treats when you:

- Spend enough money on certain things

- Buy stuff before time runs out

- Use your card every month

- Keep using your card a lot

These rewards make you want to spend more money. It feels good to get new prizes, just like in a game. Banks know this and use it to make you shop more with their cards.

When you see these rewards, you might change how you shop. You might buy more things just to get the next reward. This is how banks get people to use their cards more and more.

Digital Status Symbols Matter

We all like to feel special. Credit cards help us do that with fun rewards like points and badges. Think of them like getting gold stars in school – the more you earn, the better you feel!

When you use your card, you get points. These points help you unlock cool stuff. It's like moving up levels in a video game. You also get badges, just like kids do in scouts. These badges show others what you have done.

Some fancy cards, like the black American Express card, are super hard to get. Not many people have them. That makes them feel extra special.

People love to share their badges online with friends. They also like to show off their shiny metal cards. It makes them feel good when others see what they earned.

Level-Up Through Daily Swipes

Turn your daily spending into a fun game! Each time you swipe your card, you can win points and cool badges. It's like getting rewards for playing your favorite game.

Just like scouts get badges for new skills, you can earn rewards when you shop. Here's how to win:

- Get more points when you buy different things

- Trade points for free flights and hotel stays

- Find surprise rewards that pay for what you buy

- Collect fun badges to show what you've earned

Your card keeps track of all your points. You can use them to get cash back, take trips, or buy things you want.

Many other people play this game too – you can join them and learn new ways to win more rewards!

The best part? You don't have to do any extra work. Just use your card like normal, and watch your rewards grow.

Start playing today and see how many points you can earn!

Behavioral Economics Meets Credit Cards

Think about how you feel when you use your credit card. It's like playing a fun game! You get points and rewards that make you happy. Your brain gets excited when you swipe your card, just like when you eat candy or win at a game.

Credit card companies know this makes you feel good. They add fun things like points and levels to make you want to use your card more. It's like turning shopping into a fun game you want to keep playing.

When you pay with a card, you don't feel the same pain as when you hand over cash. This makes it easier to spend more money without thinking about it.

This is why it's smart to be careful with credit cards, even when they seem fun to use.

Social Competition Drives Card Usage

Credit cards are becoming more fun to use because we can share our wins with friends. It's like playing a game where everyone gets to join in!

When you reach a money goal, you can tell others about it. This makes more people want to join the fun.

Card companies make it feel like a game by giving you:

- Points when you spend

- Special badges for good money habits

- Fun group activities with other card users

People love to feel part of a group. They also like to show off their wins. When friends see others doing well with their cards, they want to use their cards more too.

This friendly contest helps people use their cards more and learn better money habits. It's like having a big team of friends who cheer you on when you do well with your money.

Personalized Challenges for Better Spending

Credit cards are getting smarter about rewards. They look at how you spend money and make fun games just for you. Like a friend who knows what you like, they give you special tasks to help you save.

Young people love these rewards. They use their phones to play money games and win prizes. Some games test what you know about money. Others help you track your spending. The more you play, the more rewards you get.

But some people worry about sharing their info. Only half of us trust companies with our personal details. That's why credit cards let you choose how much you want to share.

This helps you learn better ways to use money while keeping your info safe.

Ethical Implications of Gamified Finance

Money apps can feel like games, but this can cause problems. Many companies use fun features to get us to spend or trade more than we should.

Let's look at what can go wrong:

- Apps push us to trade too much, which costs us money.

- Apps show what our friends are buying to make us want to buy too.

- People online get paid to tell us what to buy.

- Fun colors and sounds make us want to take big risks.

Young people who use phones and apps trust them a lot. When apps feel like games, they often make more trades and take bigger risks with their money.

We need to be smart about how we use these apps. What looks fun could hurt our savings in the long run.

Future Credit Card Gaming Trends

Credit cards are getting more fun, like playing a game. Soon, you'll be able to see your rewards more clearly. You can also pay with digital money when you play games. You can use your phone, tablet, or computer to check your credit card, and they'll all work the same way.

Your credit card will give you fun tasks based on how you spend money. You can join groups of other people who use the same card. Together, you can share what you do and play friendly games.

The rewards you get will match what you like. Your fingerprint or face will keep your account safe. You'll also get special badges when you do well, and rewards you can use for flights or shopping.

Conclusion

Credit cards have become like fun games we play. When you use your card, you join a game where you can win points and prizes. Banks like Chase give special rewards when you spend money. Their "Ultimate Rewards" program makes people spend 46% more than cards without games. Banks use smart computer programs to make these rewards better at getting you to spend. To stay smart with your money, write down when you buy things just to get points.

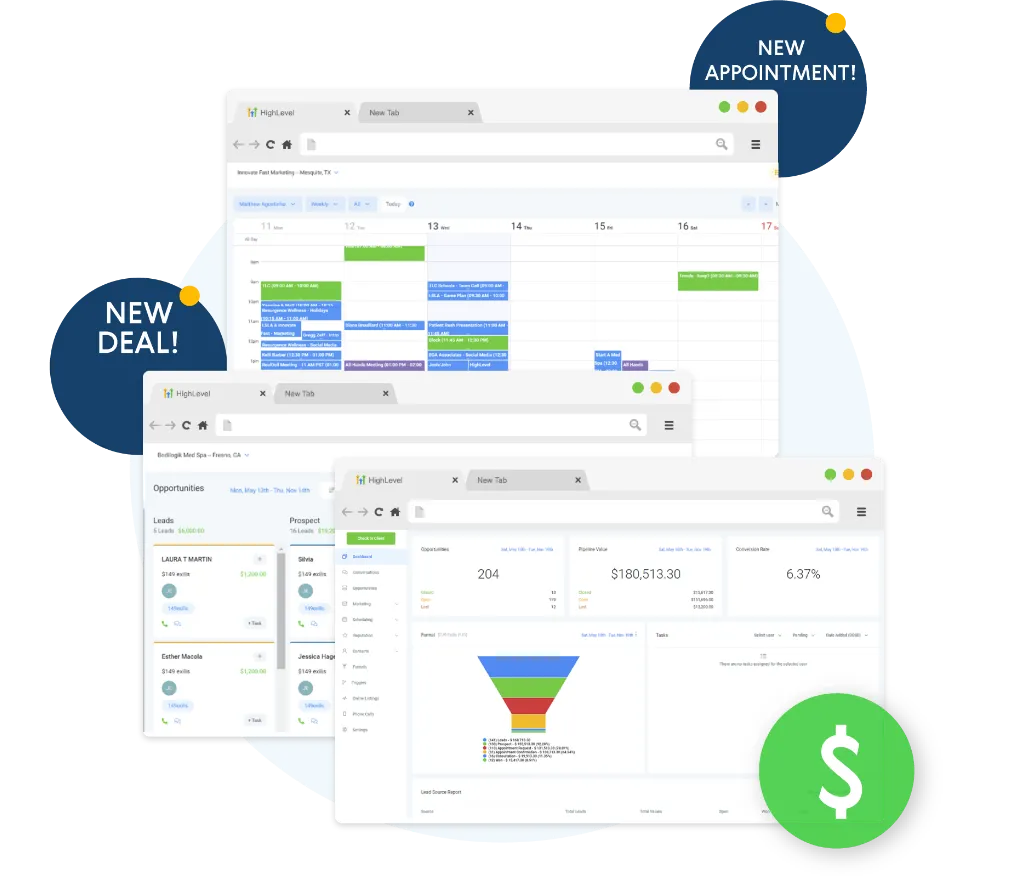

Tired of Losing Track of Customer Spending Data?

Managing customer purchase data by hand is hard work. A good CRM system helps you track spending patterns, spot trends, and find ways to reward loyal customers. It saves you time and helps you make smarter business choices.